General Insurance

What Happens if You Miss an Insurance Payment?

Will your policy gets over or you will get a grace period?

Oct 25, 2024

What Happens If You Miss an Insurance Payment?

Life is unpredictable, and with numerous financial necessities, it can be very easy to forget an insurance payment. A missed payment for health insurance, automobile insurance, homeowner insurance, or life insurance can have major consequences. But before we faint-an insurer may offer some flexibility, and there are ways to lessen the bite of that missed payment. The following article will detail what happens when you miss an insurance payment, ways to remedy the situation, and what long-lasting effects this could have on your coverage and financial well-being.

1. The Importance of Timely Insurance Payments

1.1. Why Insurance Premiums Matter

Insurance premiums are the periodic pay dues to ensure that your policies do not lapse. Here, the payments can be monthly, quarterly, or annually, and here assure an insurer of your cover should any insured event: car accident, health emergency, or property damage-arise.

In the absence of timely payments, the contract between you and the insurance provider will be in jeopardy, and it may cause a cancellation or the imposition of penalties.

1.2. Policy Continuation

The insurance policy acts as a contract between the insured and the insurer. The payment of premiums within the stipulated timeline allows the policy to remain in full force, hence guaranteeing full financial protection once a claim has been lodged. There may be various situations where a premium payment may be delayed, and protection under an insurance policy may not be available.

2. What Happens Immediately After a Missed Payment?

2.1. Grace Period

Most insurance policies provide a grace period of between 10 and 30 days after a missed payment. Your coverage continues to stay in effect during these periods; however, before the expiration of the grace period, you must pay the premium. Those who do not make payments by this period are likely to attract monetary fines or have their policies canceled.

Health insurance: often may grant a 30-day grace period during this time; your policy remains active, and you may still submit claims.

Auto insurance: varies with provider/s and/or state/territorial laws, generally permitting grace periods of between 10 and 30 days.

Life insurance: Generally, many life insurance policies allow for grace periods of 30-31 days, after such time the policy uptake might lapse or get canceled.

2.2. Notification of Missed Payment

If a payment is missed, or even a payment is late, a message like that might be sent to you by your insurance agency. The message could be sent in the form of a letter or by phone. Either something may be owing. It is best to act on it and therefore no other action be taken against you, e.g. the policy being canceled or a penalty charge.

3. What Happens If You Don’t Pay by the End of the Grace Period?

3.1. Coverage Lapse

Failure to pay up within and after the grace period of your policy means that the policy will lapse. This means that your policy is no longer in effect; any claims made after this time will not be honored. Such as a car accident that occurs after your auto insurance has lapsed- you'll have to pay for your damages or injuries out of pocket.

3.2. Policy Cancellation

Your coverage will cease immediately on some policies, and you will lose whatever protection you had under that policy if you fail to pay the premium during the grace period. Depending on the situation, it might be difficult to reinstate a canceled policy, if it can still be done at all; in any case, often some additional fees must be paid or new underwriting must be furnished.

3.3. Potential Penalties and Fees

Certain insurers charge you extra late fees or penalties for not receiving a scheduled payment while canceling your coverage. These fees may add up over time and would again make it quite costly on your part when you resume paying.

4. Consequences of a Lapsed or Canceled Policy

4.1. Higher Premiums Upon Reinstatement

In the event of a lapsed and canceled policy, reinstating the policy may entail the payment of additional premium(s). This is because, for the most part, the insurance company considers a gap in coverage as one of the stakes that the insured takes; therefore, not making a premium payment is likely to be slapped on by the insurance provider as concern over an increased risk for the future premium rate.

4.2. Gaps in Coverage

If your policy lapses, you may be left with a period of no coverage. A good example is health insurance; if this lapse occurs, you won't receive any reimbursements for medical services obtained vis-à-vis that gap. In auto insurance, the lapse could mean driving with a lapse of insurance, which would be illegal in some states or jurisdictions.

4.3. Loss of Accumulated Benefits

The consequences of missed premium payments are particularly severe when it comes to long-term policies such as life or disability insurance. For example, under a life insurance contract that bears a cash value, missed premium payments could decrease the policy's cash value or death benefit.

5. How to Avoid Missing Payments

5.1. Set Up Automatic Payments

Of course, the simplest way to prevent premium non-payment is simply by signing up with a car insurance firm that offers automatic payment terms. Plenty do, which means you can have monthly premiums either debited directly from a bank account on a set day of the month or charged to a credit card.

5.2. Use Payment Reminders

If you don't think setting up an automatic payment is the right choice for you, write in reminders in your calendar or employ notifications on your phone/computer to check your status.

5.3. Maintain an Emergency Fund

Maintain an emergency fund, which will allow you to pay insurance fees, among other monthly expenses. No matter how inconvenient, having a reserve guarantees that you will never have to let operational expenses lapse.

5.4. Review Your Policy Regularly

Regularly evaluate your insurance in relation to your paid premiums. This will easily help you stay on top of what you need to change in terms of schedules of payments. For instance, it will easily allow you to switch to a lower premium rate or be in a position to change coverage so that you will not exceed your budget.

6. What to Do If You Miss a Payment

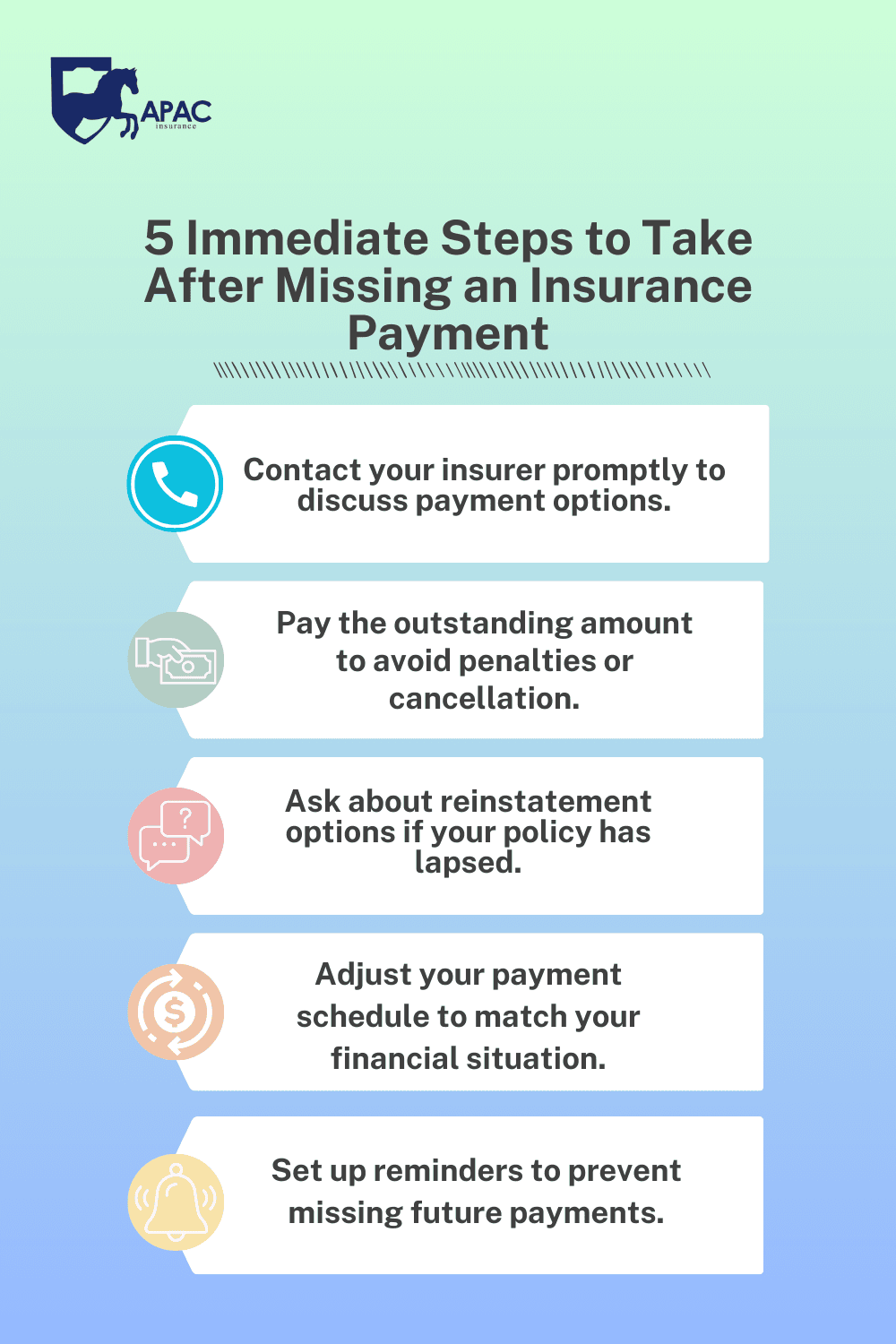

6.1. Contact Your Insurer

If you are aware at an early stage that you have not made a payment, you must contact your insurer. Some insurance companies allow for repayment flexibility or waive the penalty if a claimant takes proactive measures to resolve such an issue.

6.2. Pay the Outstanding Premium

By whatever means, arrange if possible to make payment to return your account up to date. This will prevent further consequences such as lapsing or canceling your policy.

6.3. Discuss Reinstatement Options

Make inquiries regarding reinstatement with the insurer if the policy has been lapsed or canceled. Depending on the provider or the type of policy, may require you to pay all due premiums and late fees and, sometimes, go through a new underwriting process.

6.4. Adjust Your Payment Schedule

If you are behind on your payment due to an issue of financial constraint, seek the possibility of rescheduling with your provider the way to delay your payment due dates. Some providers can accommodate an arrangement whereby your policy payments change from monthly to quarterly or annually, expected to facilitate your financial management.

7. The Long-Term Impact of Missed Insurance Payments

7.1. Impact on Your Credit Score

Missing your payment through the end of that month is unlikely to directly affect your credit score; however, if that bill remains unpaid after it is sent to collections, there could be an adverse effect. Some insurers run credit checks on you and think that your missed payments will have an impact on the generation of reasonably priced insurance quotes against a given risk undertaken during their business process of underwriting.

7.2. Difficulty Obtaining New Coverage

If you have a history of frequently missing payments or of allowing your policies to lapse, you will find obtaining new insurance more difficult. An insurer may see you as higher risk and, therefore, deny coverage or charge a higher premium.

7.3. Potential Legal Consequences

When it comes to specific types of policies, including motor vehicle insurance, it is common for many states/provinces to now require continuous coverage by law. This is linked with the potential for someone who does not maintain coverage to pay some form of fine, or be legally punished or at risk of having their driver’s license suspended.

8. Conclusion

Insurance companies allow grace periods and reinstatement options after a missed payment. Therefore, it is very important to act quickly.

The key to avoiding these issues is to stay organized and proactive. Setting up automatic payment, using reminders, creating an emergency fund, and regularly reviewing your policies are great ways to stay on track. If you do miss a payment, immediately contact your insurer to find out how to resolve the issue before it gets any more complicated. A few simple steps like these can ensure the protection of your coverage and financially.

Latest articles

stay in the loop